Episodes

6 hours ago

6 hours ago

Today’s Episode is all about collaboration.

To anyone in the London Market, VIPR has become a very well-known technology company, particularly in the area of Delegated Authority, where its Bordereaux management systems have achieved a critical mass of adoption.

But as the business looks to expand globally, particularly the huge and strategically-crucial US market, it needs to partner with existing major players to achieve its goal.

Just because we all know that weaning the insurance sector off spreadsheets and other documents is a universal problem, it doesn’t follow that a business like VIPR will automatically gain business just because it has a solution that has been tried and tested over time.

This is where Sikich comes in, as a trusted adviser implementing technological transformation, it’s picked VIPR to go to market to help prepare itself for the coming fully-digital and AI-enabled age.

In this podcast Rahul Bhatia, Principal at Sikich and Tony Russell Chief Revenue Officer at VIPR outline this alliance and the huge prize on offer to clients that are able to automate how data, not documents, flow through their businesses, from their customers and onto their own suppliers and wider stakeholders.

MGAs, particularly US-domiciled ones, have ridden a spectacular wave of growth in the past decade. If that is to continue and they are to cement their tech advantage, they need to listen to what Rahul and Tony have to say.

We live in exciting, revolutionary times and today VIPR and Sikich are at the frontier of delivering a lot of the technological change that much of the industry has been dreaming about for decades.

So if you want to know how underwriters can grow without adding to cost while at the same time becoming more skilful at underwriting and more responsive to client needs and new demand, this podcast is for you.

Rahul and Tony are hugely experienced in this field and are relatable, down to earth and easy to talk to. I can highly recommend a listen.

LINKS & CONTACTS:

https://www.viprsolutions.com/

www.sikich.com

Rahul Bhatia’s contacts are:

LinkedIn https://www.linkedin.com/in/rahul-bhatia-profile/

Email rahul.bhatia@sikich.com

4 days ago

4 days ago

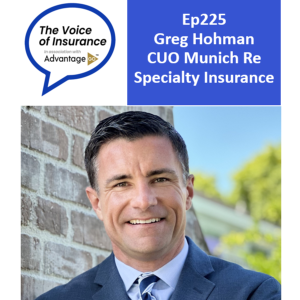

Today’s guest has one of the broadest international reinsurance roles of anyone I have interviewed on the podcast.

That’s because Louise Rose has oversight over everything that TransRe does outside of the Americas.

Louise has been on the show before as part of the annual Monte Carlo special Episode, but it’s wonderful to have the time for a comprehensive examination of the state of the reinsurance world.

And that is exactly what you get.

We cover everything from the trajectory of the market to Trans Re’s strategy as it looks to gain a stronger foothold in Continental Europe and the Asia Pacific region.

Ai, Cyber, MGAs and the state of the Casualty market all get a thorough work-over.

Louise is in her 29th year at Trans Re and is always direct in her communications style.

It’s refreshing and makes for a highly informative and valuable encounter.

NOTES:

Here’s a link to the excellent US Public D&O report that we mention in our conversation: https://www.transre.com/u-s-public-do-2025-insurance-market-update/

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday Jul 01, 2025

Ep259 Mark Allan Ki: A chance to stand out from the crowd

Tuesday Jul 01, 2025

Tuesday Jul 01, 2025

As the global subscription market digitises, the roles of market leaders and followers are becoming much more clearly demarcated.

There are businesses designed to be leaders with large investments in class-specific expertise and specialist distribution relationships who are looking to align followers and consortium partners behind them.

There is also a parallel class of follow-only underwriters looking to support and amplify those same leaders. It’s a modern twist on the oldest symbiotic relationship in the subscription market.

Ki is an example of a wholly digital business that is looking to become the ultimate following market and this expansive conversation with its CEO Mark Allan sketches out much of what the future of London underwriting is going to look like.

Ki has been a first-mover in the world of algorithmic underwriting and has built a billion-dollar business that has matured, become independent and is now offering to share its expertise as a tech partner for underwriters and brokers alike.

Mark knows more than any of his peers about what is achievable and what is likely to change in the London Market of the future.

On the basis of this conversation, the future of the market should be very bright, as it becomes much faster, more agile and responsive to brokers and clients, while at the same time becoming much more efficient and productive and a genuine alternative home for the sort of business that has traditionally only been accessible to local market underwriters around the world.

It’s fascinating and invigorating stuff. Mark answers all the big questions and many more besides. You’ll learn a lot and the time will rush past.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday Jun 17, 2025

Ep258 Mark Wheeler: Not capital-lite

Tuesday Jun 17, 2025

Tuesday Jun 17, 2025

I really enjoyed recording this podcast. That’s probably because since I last spoke to Mark Wheeler, Co-founder and Co-CEO of Mosaic Insurance, a full three-and-a-half years ago, he has been able to execute and begin to reap the rewards of all the plans he laid out in Episode 99.

There’s nothing like a sub-80 combined ratio to put a spring in your step and validate the vision you had when you founded the business, particularly when it comes relatively early in a start-up’s life.

Mosaic has now built out its global platform and wrote over 660 million dollars in gross premiums in 2024, with that number set to grow as the group continues to scale.

This interview distils the group’s highly-specialist added-value underwriter-led philosophy in excellent detail.

But at its core, this podcast is really all about a real Lloyd’s expert making the most of all the advantages of the market’s unique syndicated underwriting and capital platform.

It’s about the deep understanding of risk and the many shades of diversified capital that that risk can be connected to to create a sustainable ultra-specialist insurance business.

Mosaic has its own capital, third-party capital, specialist reinsurance relationships and a large group of syndicated insurance partners underwriting alongside it.

It is highly diversified and is set to diversify more.

It’s capital-efficient, but certainly not capital-lite.

Today this is an almost unique model but at the same time it will be a very familiar one to anyone who knows Lloyd’s longer-term history.

As the market splits into leaders, followers and data-heavy portfolio managers, here’s as good a summary of the 21st century lead underwriter model that you are likely to hear anywhere.

Mark is a charming guest and this is one of those interviews that just crackled along of its own accord, without prompts.

I can highly recommend a listen.

NOTES:

Mark Mentions a Toby. This is Toby Smith, Mosaic’s CEO of the Americas

He also mentions Burkhard, which is Burkhard Keese, former CFO of Lloyd’s.

FAL (Pronounced as a word) = Funds at Lloyd’s

CISO = Chief Information Security Officer

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday Jun 10, 2025

Ep257 Kevin Gill, Chairman of IRLA: Just scratching the surface

Tuesday Jun 10, 2025

Tuesday Jun 10, 2025

When I meet someone to record an interview they often ask me how long the podcast is going to be. My stock answer is that it entirely depends upon them.

Some people talk more than others and some people pack an awful lot into a lot less time, while others take longer to fully express themselves.

You also never quite know where the conversation is going to go and that is a huge variable.

Today’s podcast is lively, fun and gets straight to the point.

That’s because it entirely reflects our interviewee.

Kevin Gill is the Chairman of IRLA, the Insurance and Reinsurance Legacy Association.

IRLA is the UK trade body that represents insurance and reinsurance legacy management professionals and this interview will bring you right up to date with everything that is happening in this increasingly mature and sophisticated segment of the marketplace.

As legacy becomes ever more embedded as an essential, trusted service provider and capital partner for the live market we discuss how that relationship is evolving and where it might end up in the long term.

The legacy market also has its own cycles independent of the live market and so we look at the relative state of the two markets and how this affects dealmaking.

We also take the temperature of how the legacy sector feels about some of the more problematic recent live underwriting years, as well as looking at emerging loss trends and prospects for the application of emerging technology such as Ai to the sector.

The portrait that emerges is of a confident, professionalised and vibrant segment that is ready to trade and is looking at interesting growth opportunities as some of the soft-market underwriting years begin to mature.

Kevin is a breath of fresh air and there are no subjects left off the table.

My bet is that you’ll finish this episode wanting more.

NOTES:

ADC = Adverse Development Cover

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday Jun 03, 2025

Ep256 Steve Arora: You need to have sizzle

Tuesday Jun 03, 2025

Tuesday Jun 03, 2025

Today’s Episode is special and completely out of the ordinary.

Regular listeners will know that in most episodes I will talk to senior insurance and reinsurance executives and focus on what they have just done and what are about to do.

Today’s no different in that respect, but it’s a far richer encounter because of who my guest is and what he has been doing since the summer of 2023.

Until very recently Steve Arora was the co-founder of Alpine Re, a new balance sheet reinsurer looking to tap into a disrupted reinsurance market.

Alpine Re didn’t end up materialising, but only after an intense 20-month period of activity in which investors of all shapes and sizes were contacted and canvassed.

All this means that Steve is currently better qualified than even the best investment banker to talk about what investors want from the reinsurance industry.

Once you have left no stone unturned you get to see the real layout of the bedrock below and in our interview Steve goes really deeply into the appetites, hopes and fears of each investor type.

We also examine in great detail the optimal design of the model reinsurer of today.

If you had a blank piece of paper and could start a new reinsurer from scratch, where would you be domiciled and how many underwriting locations would you have?

And what would you be looking to write? Would you be a specialist or a generalist and what would your relationship with technology be?

Understandably Steve has been thinking very hard about all of these questions and his insights are highly valuable.

This episode is a great illustration of how no experience ever goes to waste. Steve is on excellent form and the interview has great pace and intensity.

In our world very few people try something genuinely entrepreneurial more than once in their careers and in this meeting you’ll learn all of the lessons that Steve has learnt from time out spent a long way out of his comfort zone.

It’s clear to me that the next role or venture that Steve becomes involved with will benefit immeasurably from this recent intense experience.

In the meantime I can highly recommend a listen.

NOTES:

During our conversation I couldn’t remember when Steve was first on the podcast. It was on Episode 8, way back in 2020 when he was CEO of Axis Re: https://thevoiceofinsurance.podbean.com/e/ep8-japan-florida-and-casualty-renewals-preview-steve-arora-axis-re/

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday May 27, 2025

Ep255 Charlie Langdale Humanity Insured: Insurance Magic

Tuesday May 27, 2025

Tuesday May 27, 2025

At a fundamental level we all know that Insurance is a force for good in the world.

You pay a relatively small premium and if your house burns down, an Insurer will help you rebuild it.

But I’m sure most of us will at some time in their careers have felt that what we do day-to-day in our insurance jobs has become increasingly removed and disconnected from those basic principles.

Well today I’m talking to someone who is trading a highly successful career in our insurance world for a new career concentrating 100% on the good that the deployment of the knowhow and structures that the insurance industry has developed can have on the poorest across the globe.

Charlie Langdale is CEO of Humanity Insured, a charity that deploys its funds to subsidise insurance premiums for communities in low-income countries.

The Aid and Development community is very reactive and only tends to arrive and try and pick up the pieces after a major loss event has happened.

This podcast goes right to the heart of the economics of aid and development. In it Charlie shows how Insurance can be a force for good and help lift people out of poverty and eventually convert them into growing insurance customers of the future – all because of a little pump-priming from organisations like Humanity Insured.

In a world filled with gloomy headlines it’s easy to despair and feel that some of the problems facing humanity are simply insurmountable.

I guarantee that half an hour with Charlie will inspire you and put a spring in your step.

For not only does he believe that the problems can be solved with the economic resources we already have at our disposal, but that it’s our industry that has already developed a lot of the solutions the world is going to need.

Whether its responding to extreme weather or even saving endangered species, Charlie has a story to tell about how insurance is already helping hundreds of thousands of people.

NOTES & ABBREVIATIONS:

The FCDO is the UK’s Foreign, Commonwealth & Development Office

LINKS:

https://humanityinsured.org/

Do get involved. New ideas can be as important as funds.

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday May 20, 2025

Ep254 Emily Apple & Andreas Wichmann Alpha Insurance Analysts: Loyal Capital

Tuesday May 20, 2025

Tuesday May 20, 2025

Today’s guests work at a Lloyd’s Members’ Agent.

Their job is to give advice and guidance to Names, the high net worth individuals providing underwriting capital to Lloyd’s Syndicates, and their clients provide just under a billion pounds of capacity to the market.

There was a time around 20 years ago when such a role might have been seen as perhaps a little quaint – one of those odd quirks that the Lloyd’s Market seems to specialise in.

Back then the brave new Lloyd’s was focused almost exclusively on corporate capital provision and private capital seemed to be condemned to a managed long-term relative decline.

A lot has changed since then.

These days Director and Head of Syndicate Analysis Emily Apple and Andreas Wichmann Business Development Director at Alpha Insurance Analysts are busy assessing a strong pipeline of both continuing and new business opportunities in the market as entrepreneurs rediscover the attraction of engaging a loyal and dedicated source of meaningful underwriting funds as part of their capital mix.

New forms of tenure for Names are also helping make them a more attractive source of capital to Managing Agents, while investors seem finally to be gaining more awareness of the many capital and fiscal advantages of underwriting as a private individual.

Emily and Andreas are hugely experienced, highly knowledgeable and great company.

They have a great overview of the Lloyd’s market and its prospects for ventures new and old and this podcast paints a detailed picture of the opportunities in the market from an investors’ perspective.

You’ll learn a lot and if you’ve ever wondered what it takes to become a Name and how the whole process works, this episode will give you all the information you need.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday May 13, 2025

Ep253 Sheila Cameron LMA: Stick to your Values

Tuesday May 13, 2025

Tuesday May 13, 2025

Today’s guest was the very first interviewee on this podcast over 250 episodes and five years ago.

She’s been on since as part of a multi-person episode, but it’s great to get her back on the show one on one.

With a new Lloyd’s Chairman, CFO and CEO all now announced and either just starting or about to start their tenures, the timing couldn’t be better.

The Lloyd’s Market Association (LMA) represents the interests of underwriting businesses at Lloyd’s and Sheila is a very effective leader, spokesperson and focal point for that hugely important constituency.

In this interview she sets out the LMA’s priorities as the Lloyd’s baton is passed to a new team.

Sheila is crystal clear on what her members want and this interview is a Tour de Force.

We cover everything from the LMA’s top ask of the new regime all the way through to the future of underwriting and capital provision in the market.

Sheila’s very direct and our conversation doesn’t duck thornier topics such as the market’s frustratingly slow technological reform process, and the difficult-to-navigate cultural reform agenda.

By the way, we made this recording a few days before the unveiling of Patrick Tiernan as the next CEO of Lloyd’s, but the messages for the incoming leader are loud and clear and still current.

The LMA is an essential and vibrant trade body and Sheila is its equally essential and vibrant voice.

And I think the result is essential listening for anyone with an interest in the future direction of the Lloyd’s Market.

NOTES:

We mention a report on Enhanced Underwriting.

This was penned by the LMA and Oxbow Partners and is entitled:

The Growth of Enhanced Underwriting in the Lloyd's Market: The New Normal?

The Executive summary and full download links are here: https://www.lmalloyds.com/LMA/lma/News/Blog/Enhanced_Underwriting_Report.aspx

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday May 06, 2025

Ep252 Michael Price & Kean Driscoll, Dellwood: One plus one is three

Tuesday May 06, 2025

Tuesday May 06, 2025

I love having insurance entrepreneurs on the show explaining their ideas and outlining the ambition they have for their business. It’s a great way to discover the best opportunities that are out there in the marketplace.

And when the guests are highly experienced, with great track records, it just means that we should pay even more attention what they are seeing.

That’s why I’m delighted that Michael Price CEO (pictured Left), and Kean Driscoll (Right), President and CUO of Dellwood Insurance Group were able to spare time out of their busy schedules to appear on the Voice of Insurance.

If you had the chance how would you go about attacking the best business opportunities in the Insurance industry today?

For Michael and Kean it’s all about exploiting the increased flow of business that is finding its way into the US Excess and Surplus Lines market.

The advent of improved technology means that lots of Small Commercial insurance and even some personal lines are now able to take advantage of the more dynamic, responsive and entrepreneurial underwriting environment to be found outside Admitted Lines.

Michael and Kean are applying the lessons learned from full careers in insurance and reinsurance to serving areas of high demand in the largest insurance market in the world.

Dellwood is a start-up working at a fascinating time, where Insurance distribution is being remoulded and new technologies such as AI are really beginning to come into their own, just as dislocation and large shifts in demand are being experienced in many segments of the market in both property and casualty.

Building a brand new player, with no financial, technological or indeed cultural legacy at a time like this looks like a very exciting move, allowing Dellwood to move fast to fill in the gaps and allow capital access to hopefully sustainably profitable pools of risk.

Michael and Kean are laser-focused on the job in hand and this podcast is full to the brim of their wisdom and expertise as they look to capitalise on a career business opportunity and build a new premium insurance franchise.

If you ever wanted to climb inside the minds of top insurance thinkers and practitioners in full flight, this is your chance.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday Apr 29, 2025

Ep251 Tom Quy Acrisure London Wholesale: Opportunity Everywhere

Tuesday Apr 29, 2025

Tuesday Apr 29, 2025

Today’s podcast is another really vibrant and forward-looking addition to the Voice of Insurance canon.

I think that’s because it’s with one of London’s most recently-appointed wholesale broking leaders, Tom Quy Managing Director Acrisure London Wholesale

Acrisure London Wholesale is a little different from many of its peers. Yes, it handles most of the same sort of high-end specialist placements that any other London wholesaler does, indeed it sources 70% of its business from outside the Acrisure Group.

But it is the scale of the opportunity that it has by being attached to Acrisure’s impressive retail network that is particularly interesting.

Acrisure has a 5% share of US commercial insurance but unlike most of its top-10 global insurance broker peers, 90% of its clients have less than 100 staff.

These are clearly not the sort of businesses that would historically have come to London for their insurance.

But here’s the interesting and exciting part. As tech brings unit costs right down and allows risk to be packaged in new and more efficient ways, the London Market and some of its more differentiated product might be brought to smaller and smaller original clients in ways that benefit underwriters, clients and the brokers connecting them.

That’s the opportunity that Tom and is team are getting to grips with and that’s what makes this such an enlightening and forward-looking discussion.

Tom’s challenge mirrors that of the entire London Market – if it can keep driving unit costs down through digitisation while at the same time keeping product quality, relevance and innovation high, it will have hit upon a rich winning formula that its brokers will be able to export around the world.

And if it can’t, the consequences don’t much bear thinking about.

Tom’s great company and is a very strong and open communicator and this Episode is highly recommended for anyone interested in the best opportunities in the global wholesale insurance markets.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Friday Apr 25, 2025

Sp Ep Risto Rossar CEO Insly: The future is already here

Friday Apr 25, 2025

Friday Apr 25, 2025

Todays’ Episode is an invigorating catch-up with someone who was last on the podcast over two years ago.

Risto Rossar is CEO of Insly and is a really rare combination in that he is an insurance business builder who realised that helping the insurance industry fully digitise would be a better and more scalable business proposition than continuing to grow the highly successful digital Baltic insurance broker that he had founded.

Insly continues to grow at speed, serving fast-growing segments of the market such as MGAs that need full end-to-end insurance software, but are unlikely to be on the radar of the largest vendors.

Risto really gets tech and insurance – but he is also a very strong communicator who tends to tell things the way he sees them.

This is where we come to the invigorating part that I mentioned at the beginning.

Risto’s trademark is no-nonsense, down-to-earth analysis of what technologies are and are not likely to be genuinely disruptive to the insurance industry.

He is good at seeing through hype and puncturing bubbles.

So when someone in his position, with his level of understanding and natural sense of healthy scepticism starts getting genuinely excited about AI, we all need to sit up and listen.

What follows is one of the most interesting and credible conversations about the likely long-term disruptive effects of AI on the insurance sector I have had on the show.

If you think AI is just going to be nice productivity tool that removes all your dull admin tasks, you need to think again – it will do that but an awful lot more besides.

The opportunities to be seized here are enormous but are difficult for those of us used to a very slow-moving status quo to get our heads around.

Risto is on exceptional form and is clearly feeling energised and excited for the future – listen on and I think you will too.

LINKS:

https://insly.com/

Tuesday Apr 22, 2025

Ep250: Adrian Cox Beazley: Managing the grey areas consistently well

Tuesday Apr 22, 2025

Tuesday Apr 22, 2025

Todays’ podcast is another really positive and uplifting meeting with someone right at the top of their game.

Fresh from posting record annual profits of over $1.4bn on a top line that exceeded $6bn for the first time, it was perhaps understandable to find Adrian Cox, CEO of Beazley in excellent spirits.

Whilst the market may be peaking in terms of pricing, speaking to Adrian it certainly doesn’t seem to be peaking in terms of profitable opportunity, and much of this podcast is a dissection of global specialist insurance opportunities in the world and how a top-tier progressive underwriter like Beazley is positioning itself to make the most of them.

Whether it be fast-emerging new classes of insurance relating to the decarbonisation of the economy, burgeoning new geopolitical risk and complexity, the rise of parametric covers, the application of artificial intelligence or indeed the fast-changing dynamics of how insurance is transacted, this encounter reveals positive new thinking and investment in abundance.

Listen on for all this and more.

I think if you listen closely enough you can hear a distillation of Beazley’s distinctive culture coming through, not just in what Adrian is saying about the issues of the day, but in the way he is saying it.

It seems that it is possible that rigour and discipline combined with worldly curiosity and a willingness to allow controlled experimentation in the understanding that not everything will go to plan can all form key parts of a successful business culture.

This is another good episode to file away for when you’re in need of a morale-booster. Adrian’s enthusiasm and good humour are infectious and I think you’ll enjoy listening to this as much as I enjoyed recording it

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday Apr 15, 2025

Ep249 Vincent Tizzio: Humility and Vigilance

Tuesday Apr 15, 2025

Tuesday Apr 15, 2025

This might be turning into a bit of a running theme, but today’s podcast is another really positive, really forward-looking encounter with the CEO of a global balance sheet business who is reaping the early benefits of a turnaround and transformation plan.

President and CEO of AXIS Capital Vince Tizzio is on really strong form in this interview.

In it we tally up where he feels AXIS is currently placed on the journey towards its stated aim of becoming the best specialty underwriter in the world.

It’s clear that large strides have been made and in our chat Vince details the ongoing programmes, both strategic and operational that he feels are going to help the business achieve his ambitious goals.

We also check in on where the best market opportunities currently lie and how AXIS is planning on making the most of them, as well as how the group is navigating opportunities such as AI and the volatile state of global risk of all descriptions.

Vince is a great interviewee because he is authentic and wears his heart and his passions on his sleeve. I certainly came away with the feeling that with him what you see is what you get.

Listen on an I think you’ll be able to hear for yourself.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday Apr 08, 2025

Ep248 Andrew Horton QBE: Growth from a position of strength

Tuesday Apr 08, 2025

Tuesday Apr 08, 2025

Today’s podcast is one of the most positive and optimistic I think I have ever recorded.

Andrew Horton Group CEO of QBE has been in the role long enough to have been able to reap some of the rewards of the changes he has made at the global insurer since he took over the top job.

Having dealt with legacy issues and posted some remarkable results that have validated his strategy – the mood from this interview is 100% forward-looking and upbeat.

Andrew’s QBE has a spring in its step and a growth plan to execute into a global insurance and reinsurance market that seems to be throwing up opportunities almost wherever you look.

It certainly helped that this was recorded on a pleasant early spring day in London, with plenty of sun in the sky and blossom on the trees, but the difference between this interview and the last one I did with Andrew two years ago is palpable.

Today, Andrew is buzzing with energy and good humour and has audibly grown in confidence. In this discussion we make light work of all the issues of the day, taking in topics as diverse as Reinsurance, D&I, the long-term trends of facilitisation and algorithmic underwriting and their consequences, Lloyd’s and the London Market, and insuring the transition.

So listen on as we take a world tour of market opportunities and a refreshed and revitalised player looking to seize the moment. If you are feeling jaded and in need a tonic – this is just what the doctor ordered!

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

We also thank audio advertiser, The Insurance Network (TIN), organiser of the highly-successful TINtech events series and Data Jam. www.tin.events

Tuesday Apr 01, 2025

Ep247 Brian Duperreault: Playing the Long Game

Tuesday Apr 01, 2025

Tuesday Apr 01, 2025

Today’s guest is without doubt the most successful insurance executive I have had on the show.

He’s also completely unique in that he is the only insurance boss I am aware of to have run one of the world’s largest insurers and its largest broking group.

Brian Duperreault is insurance royalty. Having started his career at AIG, he then transformed ACE from a Bermudian upstart to a major global player.

He then ran MMC and set it on the road to a radical recovery, founded Hamilton Insurance and then helped AIG get a spring back in its step

He has now just founded Mereo Advisors in probably one of the most difficult funding environments for balance-sheet businesses in his long career.

But this introduction shouldn’t be a run-through of his superb résumé – most of you know all of that already.

Before this meeting I’d met Brian a couple of times. I had a brief interview with him once in the early days of the Hamilton era and had chaired him onstage at an Insurance Conference.

But today’s episode really showcases why the podcast can be a much more intimate and valuable medium than others.

In this encounter we had the luxury of less time pressure and what resulted was a long and expansive conversation that is something very different.

If you want to know how Brian has found success, listen on – it comes through loud and clear in every sentence.

Brian cares deeply about what he does, but it’s obvious he cares about all the people in the organisations he has run even more. He is a rare CEO, not because he is brave, morally upstanding, strategically audacious, a natural underwriter and risk-taker who is strong when executing difficult decisions and has a clear vision for how create, grow and run great insurance businesses – he’s got all of that in abundance.

But on top of that he is self-aware enough to know instinctively when he should hand over to a successor and try something new. As he puts it, he knows you can let a role define you and it can get really hard to leave when you’re the big successful boss and everyone always laughs at all your jokes!

Some of Brian’s most lasting achievements have not just been the growth and performance of businesses while he has run them, but the robust state he has left them in and the continued sustainable growth they have all achieved after he has moved on.

I could go on – but I think you get the picture by now.

Listening back, I think we managed to do the opportunity justice.

Brian’s also great fun and we ended up laughing a lot more than I had imagined when poring studiously over my research and reading the superb Biography that has just been written about Brian by longstanding former colleague Wendy Davis Johnson in preparation for this interview.

This podcast contains an enormous amount of highly valuable advice. My advice is to listen on and take it all to heart. If as a result anyone listening achieves even a tiny percentage of the success that Brian has, it will have been time well spent.

LINKS:

Faith and Purpose, The Life and Vision of Insurance Icon Brian Duperreault, is out now and available here:

https://duperreaultbio.com/how-to-order-faith-purpose/

I can highly recommend a read.

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

We also thank audio advertiser, The Insurance Network (TIN), organiser of the highly-successful TINtech events series and Data Jam. www.tin.events

Tuesday Mar 25, 2025

Ep246 Mike Keating CEO, MGAA: No Bubble to be Burst

Tuesday Mar 25, 2025

Tuesday Mar 25, 2025

This week’s guest has probably the best 360-degree understanding of the insurance value chain of anyone I have had on the show.

This is because Mike Keating has a career that spans collecting insurance premiums in person and runs all the way through underwriting, backing MGAs, working for and founding MGAs, to working for Private Equity and helping find investment to start new insurance businesses.

Now Mike is putting all he has learned into running the Managing General Agents Association (the MGAA) the trade body that represents the MGA community in the UK and Ireland.

The MGAA’s members write around £15bn – or just under $20bn - in GWP, so this is an organisation that carries quite a lot of weight in the market.

In this podcast we examine the reasons behind the continued success of the MGA as a vehicle for delivering underwriting talent and the prospects for their growth to continue sustainably into the future.

We also learn what is on the MGAA’s agenda, in terms of the lobbying work it does as well as what are the latest initiatives from the important educational and networking sides of the organisation.

But leaning on Mike’s broad experience, our topic ranges are far wider than that. For example, a large part of our discussion extends to include the application of AI in the MGA space.

With the average tenure of the underwriting paper backing MGAs hitting new highs, MGAs providing the preferred career path for many underwriters, and with someone as passionate and knowledgeable as Mike looking out for its interests, the future for the UK and Ireland MGA sector looks very healthy.

But most importantly Mike is great company and an insurance player through and through and the best possible reason to listen to this podcast is to get the benefit of some of the insights that his long experience has given him.

NOTES:

We mention Reg Brown. Reg is a Lloyd’s luminary who ran his own Syndicate and is the driving force behind founding the MGAA, as well as many other market-wide initiatives and collaborations, most notably the Insurance Museum, of which he is Chairman.

https://www.linkedin.com/in/reg-brown-62827313/

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

We also thank audio advertiser, The Insurance Network (TIN), organiser of the highly-successful TINtech events series and Data Jam. www.tin.events

Tuesday Mar 18, 2025

Ep245 Lucy Clarke: Sleeves Rolled Up

Tuesday Mar 18, 2025

Tuesday Mar 18, 2025

Today’s guest is making a return to the show after a three-year gap.

That’s way too long for me because the last time she was on the podcast she made such a strong impression that I described her as a dream interviewee.

But there are good reasons for the gap – not least a year’s gardening leave as she moved to take on one of the biggest jobs in broking.

Luckily for all of us Lucy Clarke, President of Risk and Broking at WTW is back on the show.

She’s still the dream interviewee and given her important new role and Willis’s re-stated ambitions to restore the sheen to this historical jewel in the global broking crown, she’s more of a dream guest than ever.

This podcast doesn’t disappoint. In this interview I found Lucy on top form, fully established in her new role and clearly revelling in the task in hand.

Here we unpick all of Willis’s strategy, from it’s ambitious return to reinsurance to its audacious digital broking initiatives, and we put all this in the wider context of Lucy’s extraordinarily broad view of the market’s ebbs and flows as well as its permanent structural changes and external opportunities and threats, such as those presented by AI

Nothing was off the menu and with Lucy what you see is what you get – her drive and passion are always on display.

Here’s someone with their sleeves rolled up and clearly enjoying a dream job scenario unfolding in front of them.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

We also thank audio advertiser, The Insurance Network (TIN), organiser of the highly-successful TINtech events series and Data Jam. www.tin.events

Tuesday Mar 11, 2025

Ep244 Ian Gutterman: Insurance Hot Potatoes and Movie Sequels

Tuesday Mar 11, 2025

Tuesday Mar 11, 2025

Today’s episode is different because I’m not talking to an industry CEO, but somebody who has made a career of holding industry CEOs to account.

Since before the turn of the millennium Ian Gutterman has been analysing the insurance industry on behalf of investors and in that time has sparred with all the top CEOs and executive teams.

Analysts and journalists are kindred spirits – we both sit on the outside of the industry looking in and we both tend to speak to the same sorts of people, although we tend to ask different sorts of questions when we do.

After a while we tend to seek each other out to compare notes.

Journalists seek out the smartest analysts with the strongest personalities and the best communication skills and get them to explain some of the more technical and academic questions driving the industry.

Ian is a journalist’s dream because he is incredibly intelligent but also refreshingly direct.

Ian has personality and strong convictions in abundance and in this episode we cover all the big questions affecting the industry today, from when the 15-year bull market for intermediary valuations might come to an end, the wider consequences of the California wildfires and whether the insurers really have a proper handle on cat risk, to whether recent bouts of casualty reserve strengthening are now the end of the matter, or the lessons from the insurtech boom and why Venture Capital and insurance don’t mix.

Ian and I had a lot of fun on this recording. Listen on and I think you will too

Enjoy the podcast

NOTES

Ian writes a really strong insurance blog at https://iansbnr.com/ I always read it and I highly recommend you do too. It rarely pulls any punches.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

We also thank audio advertiser, The Insurance Network (TIN), organiser of the highly-successful TINtech events series and Data Jam. www.tin.events

Friday Mar 07, 2025

Friday Mar 07, 2025

Today’s episode is packed full of really practical insights because this one is all about making things happen.

So often in our sector we can very clearly see the change we have to make or the new system we have to adopt to be able to improve the way we do things, but we find it really hard to achieve final implementation.

It’s as if the green pastures are right in front of us, tantalisingly in view, but there is a steep ravine that we have to cross to get there.

As Ian Summers (Pictured, Top), who has been helping his employers and clients implement major change projects all his long career notes in this podcast, it’s incredibly common that the change management side of a project is overlooked or underestimated.

And even if the systems are ready, are the people in the business really ready to start using them with confidence?

This kind of skill is a very specialist one and its very specific to each industry. That’s why it is great to have insurance change management specialist Melody Miller (Pictured, bottom) on the show.

Melody is an Executive Director at Sea Change London, which is a member of AdvantageGo’s ecosystem and is an expert in getting complex, time-sensitive and often existential mega change projects over the line.

In this podcast we dissect the major changes facing players in the London and International insurance markets.

Ian and Melody are on excellent form and do a great job of simplifying often complicated ideas so that laypeople like you and me can understand them.

So, if you want to learn how to handle change better and get an expert feel for where difficult market-wide projects including the transformational but mission-critical Blueprint Two might be headed in 2025, I can highly recommend a listen.

LINKS:

We thank our sponsor AdvantageGo:

https://www.advantagego.com

https://www.seachangelondon.com

Tuesday Mar 04, 2025

Ep243 Graham Evans Westfield Specialty: A Good Steward of Insurance Capital

Tuesday Mar 04, 2025

Tuesday Mar 04, 2025

Today’s Episode has a really special feel to it and that’s all down to this week’s guest.

Graham Evans is Executive Vice President and Head of International Insurance at Westfield Specialty Insurance and is bringing all that experience to bear as US Mutual Group Westfield looks to build out a globally diversified specialty operation to complement its core US insurance business.

In this podcast we assess the prospects for the London and broader International specialty insurance markets and go into detail about Westfield International’s ethos and growth strategy moving forward.

Graham has been working in the underwriting rooms of the London Market since the mid-1980s, so has been a London underwriter boy and man through markets of all descriptions.

His is the sort of experience that is exceedingly hard to replicate and, listening back to this recording, it’s plain that all his answers bring a lifetime of London Market expertise to bear.

This makes for a very enjoyable listening experience, particularly when the current prospects for the London Market are looking more exciting than at any other time in Graham’s long career.

So listen on as Graham explains how the 177-year-old Westfield Group is planning to bring something a little different to the already eclectic mix of the London and International insurance markets.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday Feb 25, 2025

Tuesday Feb 25, 2025

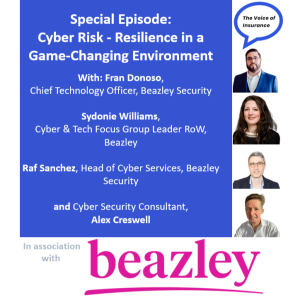

Cyber insurance has been on an epic growth journey in the past decade and in that time has been transformed from a new and exciting product into a maturing pillar of the global specialty insurance and reinsurance market.

This is a class of business that has come so far that is now developing its own catastrophe treaty reinsurance and Insurance-Linked Securities (ILS) markets

Those developments has been made possible in large part due to the enormous investment that the broader Cyber ecosystem has made in researching, protecting, remediating and modelling the risk that underwriters and the capital backing them are taking on.

Cyber modelling specialist CyberCube has been one of the prime movers behind this increased market sophistication and is also a member of AdvantageGo’s ecosystem.

In this podcast I get a masterclass on the state of the cyber market from Ross Wirth, CyberCube’s Head of Partnership & Ecosystem (pictured bottom) and this is reinforced by a vision of what a smart state-of-the art underwriting work bench and underwriting control system can currently do and will be able to do in the near future from Simon Fagg, (pictured top) who is a Director and Product & Solutions Strategist at AdvantageGo.

Simon has had a fascinating a career during which he has made the transition from underwriting itself to the design of underwriting systems and Ross has over 20 years’ experience leading complex change programmes at global insurers.

Between this remarkable duo we have all the bases covered.

So, I f you are interested in where the cutting edge between technology and best-in-class underwriting is today, and where it is heading in the coming years, listen on, I think you will find this a very rewarding experience.

LINKS:

https://www.advantagego.com/

https://www.cybcube.com/

Tuesday Feb 18, 2025

Tuesday Feb 18, 2025

Today is a first.

I’ve had a many senior industry executives on the show who have started their careers as actuaries, but I’ve never met anyone who already knew when they left school that they definitely wanted to be one.

Martin Burke is different and this is what makes him an excellent podcast guest. In his own words he has walked something of a squiggly career path that has brought him to his current position as Chief Underwriting Officer at Lloyd’s stalwart MS Amlin.

But having walked all the bends in the road to get where he is now has made Martin an extremely well-rounded CUO.

It’s obvious none of his time spent on reserving, pricing and in the finance and risk departments has gone to waste. To re-run the cliché, actuaries aren’t famous for being great communicators, but that just makes the ones who are stand out.

Martin has the gift of the gab and that makes him a high value guest to someone like me.

An interviewee who can understand and, more importantly, summarise and explain complicated ideas in a way that laypeople can understand, is podcasting gold dust.

And when that person is also responsible for profitably growing a £2bn (US$2.5bn) book in today’s market, this makes for a complete and satisfying listen.

Here we run through MS Amlin’s strategy in an evolving market and take in Martin’s views on an eclectic range of topics, including the impacts of the latest major loss activity on insurer and reinsurer appetites, the best applications of technology and Ai, as well as his priorities for where he feels the London Market should be developing as a collective as the leadership regime at Lloyd’s transitions.

I think you’ll find Martin fun to spend time with and full of surprises.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday Feb 11, 2025

Ep241 Ben Hubbard Parsyl: In the business of rewarding the best clients

Tuesday Feb 11, 2025

Tuesday Feb 11, 2025

I’d like you to cast your mind back to 2016 when the insurtech phenomenon really started to emerge.

It was a very exciting time as tech entrepreneurs and venture capitalists had finally spotted the huge opportunities that would become available if they started to use their skill and financial wherewithal to help transform the way the global insurance industry goes about its business.

The task was daunting, but the possibilities seemed endless.

That year Ben Hubbard co-founded Parsyl, the business he still heads today.

The firm made it into the first cohort of the Lloyd’s Lab and hasn’t looked back.

Now in 2025 Parsyl has come through its adolescence and has a made an impact in a niche segment of the cargo market where it has first been able to use its tech savvy to give itself a sustainable competitive edge.

Now eight years into the project, I’d argue the excitement is now greater because Parsyl is only just getting going and is poised to move into new lines of business.

Parsyl’s insurtech peers that didn’t make it usually failed because they were tech companies that didn’t know if they wanted to completely disrupt or collaborate with the incumbent insurance market – and it also turned out that many of them fundamentally underestimated how hard insurance can be to execute well and at the right scale.

Parsyl is still here and thriving because it embedded itself in an entrepreneurial corner of the Lloyd’s market and has taken the best it has to offer, while adding its own extraordinary, almost alien layer of technological understanding on top.

It’s a best of both worlds philosophy.

So often we hear or read about the future of underwriting, as if it is something that hasn’t quite arrived yet, but will come eventually, if only we can be a little more patient.

Well, the wait is over – what Parsyl has built has fulfilled the promise of 2016 and then some

Ben and I met face to face on a stormy London afternoon in winter and the conversation fairly crackled along.

I defy you not to be enthused by Ben’s affable and easy-to-digest philosophy on how to make insurance better, more relevant to clients and more profitable for its capital backers.

Just to give you a taste, this is a business that already runs 100% of its submissions through Ai, constantly revamps its products over rolling two-week cycles and updates its models from experience and new third-party data every four months.

For incumbents this is jaw-dropping stuff. Luckily for us Ben is a friendly face who can help make this revolution palatable and easy to understand.

The future’s already here, so listen on to get yourself up to date.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Thursday Jan 30, 2025

Sp Ep: The Fast-Evolving World of Employment Practices Liability

Thursday Jan 30, 2025

Thursday Jan 30, 2025

Today’s episode is going to dive deep into the fascinating world of Employment Practices Liability, or EPL.

This $4-5bn premium class of business is one that has grown into a standalone specialist line over the last 25 years and is one whose growth is almost guaranteed to continue into the future.

I say that growth is almost guaranteed because its progress is almost wholly aligned with the parallel progress of society at large.

As society develops and standards and expectations are raised in the workplace, so the consequences of failing to keep up with best practice will become steadily more severe for employers who fall behind.

Legislation changes and over time tends to create new forms of liability for employers.

At the same time unwritten societal norms evolve, almost always faster than the legislation can keep up.

Behaviour that might have been acceptable or even encouraged 30 years ago may today be the cause of new grievances and complaints in the workplace.

Similarly, as technological change accelerates and the way we work and where we work evolves, so new avenues for potential claims are being created at pace.

Also as workforces age and become more diverse, once again the potential for conflicting views on what is and what is not acceptable conduct by colleagues, employees and bosses of differing ages and cultural backgrounds is increased.

To sum up some liabilities are statutory and laid out in black and white, but others are becoming far more subjective; one person’s idea of absolute impartiality may be another’s idea of unjustifiable discrimination. Something many see as harmless teambuilding fun might be harassment when viewed from another perspective.

And because many employers and industry sectors follow very similar HR systems, Employment practices claims are also potentially systemic in nature. This merely adds potential fuel to the fire.

There’s an awful lot going on here and this is clearly not a line of business that the unprepared should be dabbling in.

That’s why I have assembled a trio of experts from underwriting, claims and the legal profession to shed light from all angles on the core questions and key trends affecting this dynamic class.

Bethany Greenwood (pictured top) is Beazley’s Group Head of Specialty Risks and Kamal Chhibber (pictured middle) is its Claims Focus Group Lead for International Financial Lines.

(By the way, Kamal Chhibber is known as Chhibbs by everyone, so this is how he is addressed throughout the podcast)

These two senior insurance practitioners have been professionally assisted by Louise Bloomfield (pictured bottom), a partner at UK law firm DAC Beachcroft.

The intention is that this podcast will be of value to anyone with an interest in this burgeoning casualty line and the fast-evolving cultural and legal territory that it inhabits.

I’ve spoken to the experts, so you absolutely don’t have to be one yourself.

NOTES AND ABBREVIATIONS

ADA = The Americans with Disabilities Act (US)

EEOC = The Equal Employment Opportunity Commission (US)

ACAS = The Advisory, Conciliation and Arbitration Service (UK)

RECOMMENDED FURTHER READING

Beazley has just launched a report entitled Spotlight On Boardroom Risk 2024

It deals with the evolving boardroom risk landscape, from business interruption and supply chain risks to regulations, reputation, and employer risks.

Tuesday Jan 28, 2025

Ep240 Mike van der Straaten CEO Antares: Keeping insurance personal

Tuesday Jan 28, 2025

Tuesday Jan 28, 2025

Today’s guest is someone with the essence of insurance running right through his veins.

That’s because he has been working in our industry since the age of sixteen and has accumulated over forty years of experience.

Now as CEO of the Lloyd’s and Bermuda insurer and reinsurer Antares Mike Van der Straaten has a unique viewpoint of the global insurance market from which to apply his accumulated knowledge and understanding.

Like many of its peers Antares has undergone a rebuilding and restructuring in the past few years and after steadying and right-sizing its business is now stepping out to seek measured profitable growth once more.

I found this a really enjoyable and enriching discussion.

In a world seemingly dominated by PhDs, Mike’s remarkable career is a reminder that, when it is performing as it should, the insurance industry is an education and vocation rolled into one and rewards intelligence, creativity, common sense and hard work in the most meritocratic of ways.

Mike is a great guest and blends the best of the old and the new.

For example in this podcast we examine many of the factors that don’t change, such as the shifts in the market cycle and distribution trends, but at the same time we also dissect some of the most progressive issues affecting the sector, such as the best applications of Ai and the streamlining of the underwriting and placement process.

Mike always says what he thinks and this candour is extremely refreshing.

NOTES:

We mention a Rolf Tolle. Rolf was Lloyd’s first Performance Management Director.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

Tuesday Jan 14, 2025

Ep239 Chris Williams Tokio Marine International: Nurturing Global Insurance DNA

Tuesday Jan 14, 2025

Tuesday Jan 14, 2025

Today’s Episode is exceptional because in terms of his seniority and the sheer size and global nature of his role, my guest is in a very small peer group.

Chris Williams is Chairman of International Business at the Tokio Marine Group and that means he helps oversee a business with a $75bn dollar balance sheet and 44,000 employees, operating in over 40 countries.

Only a handful of my guests on this show in the last five years have a role of such global depth and breadth.

An Australian who has worked in London and spent most of his career in the US, Chris is very much a model citizen of the global specialist insurance and reinsurance world that this podcast looks to serve.

In the past twenty years Tokio Marine Group has embarked on a highly successful internationalisation strategy that has entailed multiple blue-chip acquisitions in countries all over the world.

This has turned it from a dominant Japanese insurer with only around 3% of earnings coming from overseas into a global force that already makes around 75% of its earnings outside of Japan, with that proportion almost certain to continue growing over time.

Chris joined the group through its 2015 acquisition of HCC so in many ways is the personal embodiment of this strategy.

This podcast is a great distillation of that Tokio global plan and where it may be heading next, but it’s also a chance to pick the brains of an industry veteran who can combine a fifty-year career with a genuinely global overview.

Chris’s views on the rise of MGAs, the prospects for renewed M&A in 2025, the best application of AI, the debates over rate and reserve adequacy in the casualty space and the overall state of the global market are all unequivocally and candidly expressed here.

Chris is exceptionally good company and I caught him on great form in this podcast.

He may be one of the most senior executives in our world but at heart he still comes across as a genuine, down-to-earth Australian who tells things the way he sees them.

The fact that he has seen so much in such a wide and varied career just makes this Episode all the more valuable.

Listen on and you’ll see what I mean. I guarantee you’ll enjoy it and learn a huge amount.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

We also thank audio advertiser, The Insurance Network (TIN), organiser of the highly-successful TINtech events series. This week they are advertising their successful TINtech London Market event, which will be happening on 4th February 2025.

Friday Jan 10, 2025

Ep238 James Vickers: 1.1.25 - Not a Blind Soft Market

Friday Jan 10, 2025

Friday Jan 10, 2025

Today’s Episode is half of a duo of special podcasts released simultaneously that are looking to summarise the 1.1 reinsurance renewals.

In previous years I have compiled these interviews into a documentary-style episode to work as a précis, but this year I enjoyed my interactions so much that I really didn’t want to be chopping them up into clips, so I have produced two separate episodes instead.

Both my guests will be familiar to regular listeners and they both bring very different, very complimentary qualities. For a full picture of the renewal and the current state of the reinsurance market I highly recommend you listen to both

This Episode is with James Vickers, Chairman of Gallagher Re International, who has been at the forefront of the reinsurance broking world for over forty years.

The other, Episode 237, is with David Flandro, Head of Industry Analysis and Strategic Advisory at Howden Re. With David we examine all the broad macro factors washing across the reinsurance market and get a great feeling for the big picture.

But in this podcast with James we get into much more micro detail.

This satisfying discussion examines the annual close encounter between clients’ wants and needs and reinsurers’ appetites as well as their red lines.

A listen will tell you that this market is not as black and white as a quick read of some of the simple headlines about declining prices might have you believe. There are many shades of grey and an enormous amount of differentiation is happening between reinsurers and their customers

James is on exceptional form and in this episode he doesn’t duck any of my questions and we don’t leave any stones unturned.

If you want to be really well informed you need to talk to someone as personable and in the know as James – come and join us!

Gallagher Re has published its comprehensive 1.1 First View report entitled Differentiation Rewarded.

Make sure you Read it along with this Episode

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

We also thank audio advertiser, The Insurance Network (TIN), organiser of the highly-successful TINtech events series. This week they are advertising their successful TINtech London Market event, which will be happening on 4th February 2025.

Friday Jan 10, 2025

Ep237 David Flandro Howden Re: 1.1.25 - The water is still warm

Friday Jan 10, 2025

Friday Jan 10, 2025

Today’s Episode is half of a duo of special podcasts released simultaneously that are looking to summarise the 1.1 reinsurance renewals.

In previous years I have compiled these interviews into a documentary-style episode to work as a précis, but this year I enjoyed my interactions so much that I really didn’t want to be chopping them up into clips, so there are two instead of one.

Both my guests will be familiar to regular listeners and they both bring very different, very complimentary qualities. For a full picture of the renewal and the current state of the reinsurance market I highly recommend you listen to both

This Episode is with David Flandro, Head of Industry Analysis and Strategic Advisory at Howden Re. David has a deep analytical background, but in his long career has not, as far as I am aware, had to broker and place a risk in anger.

The other, Episode 238, is with James Vickers, Chairman of Gallagher Re International, who has been at the forefront of the reinsurance broking world for over forty years.

With James I will be getting more into the detail of the cut and thrust of the annual duel between clients’ wants and reinsurers’ red lines and ascertaining this highly experienced broker’s feel for today’s marketplace.

But let’s get back to this podcast.

In this lively discussion we examine all the macro factors washing across the reinsurance market in great detail.

A listen will be a great education on how the best analysts gain their understanding of the market and will give you a good idea of where we are now and where we might be heading in 2025, provided external events don’t blow us off course.

David may be one of the smartest people in our business, but he’s also great fun to spend time with. He is so good at explaining complicated ideas about the fundamental capital building blocks of insurance and reinsurance and the factors that affect them, that he always makes me feel a lot smarter for having spent time with him.

NOTES

Howden Re has published an extremely detailed and comprehensive report full of insights entitled Past the Pricing Peak Read it along with this Episode.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

We also thank audio advertiser, The Insurance Network (TIN), organiser of the highly-successful TINtech events series. This week they are advertising their successful TINtech London Market event, which will be happening on 4th February 2025.

Tuesday Jan 07, 2025

Ep236 Andrew Matson Augment Risk: Ten times the value, not ten points off

Tuesday Jan 07, 2025

Tuesday Jan 07, 2025

Today’s guest is a rare breed of broker looking to build a sophisticated new intermediary operating at the higher end of the market.

In the past two years the business he leads has gone from a standing start to handling around $1.6bn in premiums.

Andrew Matson and Augment Risk have done this by being very targeted and very progressive, breaking insurance and reinsurance down to its core element – capital.

At a fundamental level insurance is a tool for capital protection and capital management. If designed and executed well this is a tool that produces better outcomes for clients and these benefits are ultimately measurable in improved return on equity.

Of course, what I have just described is about as far removed from the traditional broker model as it is possible to be.

This model might not be for everyone, but that is beside the point. Augment is already demonstrating that there is an eager community of sophisticated global buyers keen to discover what a holistic client- and capital-focused broker might be able to do for them.

And that’s what makes this encounter so interesting. Andrew has a singular vision for what he wants to achieve and after this podcast you’ll be in on the act too.

But we don’t just talk about Augment’s plans: legacy, parametric insurance, the future of insurance securitisation and the long-term effects of the digitisation of the insurance value chain are all examined in depth.

Andrew is ultra-smart and highly passionate and his ambition sears through this episode.

For anyone disillusioned with siloed, product-focused and constrained broking, here is someone with a genuinely attractive and genuinely original proposition to put to you.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

We also thank audio advertiser, The Insurance Network (TIN), organiser of the highly-successful TINtech events series. This week they are advertising their successful TINtech London Market event, which will be happening on 4th February 2025.

Friday Jan 03, 2025

Sp Ep Graham Elliott CEO Crux Underwriting: Seeking Alpha

Friday Jan 03, 2025

Friday Jan 03, 2025

Today’s episode is an absolute blast. That’s because the person I am talking to is unique.

And I think that’s because he spent quite a large proportion of his career a long way outside insurance and discovered our sector relatively late.

But the crucial point is that it wasn’t that late.

Graham Elliot CEO of Crux Underwriting had enough experience outside the sector not to be too dyed in the wool and full of industry preconceptions, but he has been with us long enough to have had time to have already made a serious entrepreneurial impact on our sector at Oxygen Insurance Brokers, Aqua Underwriting and Azur Group.

I first met him about eight years ago at the beginning of the insurtech boom and found him incredibly valuable as someone who was very eloquent and adept at explaining the benefits of technology to a traditional insurance audience in words it could understand.

Graham’s latest venture is Crux Underwriting, a new Lloyd’s MGA he has set up with experienced Political Risk and Political Violence underwriter, Mike O’Connor.

But this podcast is way broader than Crux’s opening line of business. Our talk is an incredibly wide-ranging tour of the most advanced thinking around how global wholesale and specialty insurance and reinsurance is set to develop in the digital age that is currently dawning.

AI, algorithmic trading, genuinely realtime digitised underwriting systems and the reasons behind the boom in MGAs are all discussed in great detail.

If you still haven’t quite got your head around where the market is likely to be heading after our digital big bang is finally reached, I recommend this talk as a wonderful place to start.

Graham is charismatic and charming and I guarantee it won’t be long before your imagination is sparked and you are swept up in the positive appreciation of some of the enormous opportunities that are available to smart entrepreneurs in today’s market.

This is a great way to start the year.

LINKS

We thank our Special Episode sponsor Stephens Rickard:

https://www.stephensrickard.com/

Tuesday Dec 17, 2024

Tuesday Dec 17, 2024

Today’s guest can boast a 40-year career in the reinsurance business and now leads a global reinsurer with around $3bn in gross written premium and approximately 250 employees.

Dieter Winkel is President of Liberty Mutual Re and this podcast is very timely, given its positioning just ahead of the key 1.1 reinsurance renewal season.

Dieter is everything you want in a reinsurer: experienced, probably unshockable and very measured and consistent, as well as being easy to talk to.

In this Episode we cover all the major issues affecting the global reinsurance market, from the general state of the market cycle, and trends in global specialty, property and casualty and retro all the way through cyber to the burgeoning world of parametrics and the best applications of AI in reinsurance.

This a very enjoyable interview with a consummate reinsurance professional, who has lived through multiple market cycles and is an excellent communicator and great company to boot.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

We also thank audio advertiser, The Insurance Network (TIN), organiser of the highly-successful TINtech events series. This week they are advertising their successful TINtech London Market event, which will be happening on 4th February 2025.

Tuesday Dec 10, 2024

Ep234 Distribution & Expertise: Walking the City with David Howden

Tuesday Dec 10, 2024

Tuesday Dec 10, 2024

Today’s podcast is a first for The Voice of Insurance. It’s the first time I’ve done an outside broadcast.

And the reason is a special one. David Howden started what was then Howden Pangbourne just over thirty years ago with two others and, famously, a dog, in a tiny office on St Dunstan’s Hill in London.

Now that business is around six thousand three hundred times bigger in terms of staff numbers and infinitely larger in terms of revenue and has become a major global insurance and reinsurance operator working all over the world.

I had been trying to get David back on the show for a while as it had already been 2 years since his last appearance alongside Rod Fox after the acquisition of reinsurance broker TigerRisk.

The message came back that he might be tempted to do it as long as we could do something different.

So this is indeed completely different.

David and I met up at St Dunstan’s one morning two weeks ago and went for a walk around the Insurance district of London we both know so well, taking in the sights, but also all of Howden’s five London head offices past and present along the way.

Inevitably we get a bit of a history lesson and hear lots of insightful stories and some fun anecdotes from along the amazing Howden entrepreneurial journey of the last three decades amid a fast-changing London and international insurance market.

But far more importantly we also discuss the core issues affecting the present and the future of that market and how Howden is positioning itself within it.

Howden Re, Dual and the MGA boom, the big question over whether Howden might enter US retail broking, ongoing broking consolidation, big capital questions around what structures make the most sense as Howden continues to scale, the firm’s latest 30/30 strategic plan and other key decisions facing the Howden Group now and over the decades to come all get comprehensively dealt with.

There’s nothing like a good walk for opening up a better quality of conversation.

David’s passion and enthusiasm are fizzling through every second of this fun and all-encompassing discussion.

If you want to know how David got this far do listen on, you’ll learn an awful lot.

But I think a better reason to carry on listening will be to hear where he is heading in the next few years and how he plans to get there.

By the time we close our conversation in Dave’s Wine Bar at the foot of Howden’s current HQ, you’ll be much wiser, but probably needing a sit down and a cup of coffee as much as I was.

NOTES:

If this has piqued your interest, there are some handy highlights of the Howden story here:

https://www.howdengroupholdings.com/about-us/our-story

The other broking firms that get the most mentions in this Episode are Spear Gulland, acquired by Howden in 1997 and major Spanish intermediary Gil y Carvajal, bought by Aon in 1998.

I worked at Gil y Carvajal’s London office from 1992-95 and again 1997-98, hence my extra inside knowledge of St Dunstan's.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

We also thank audio advertiser, The Insurance Network (TIN), organiser of the highly-successful TINtech events series. This week they are advertising their successful TINtech London Market event, which will be happening on 4th February 2025.

Friday Dec 06, 2024

Friday Dec 06, 2024

Today’s episode is the latest in a series of podcasts that are all about highlighting the technology companies that are part of AdvantageGo’s ecosystem.

And this one is really special because it involves the boss of one of the ecosystem’s most essential core partners.

Aidan O’Neill is the CEO of DOCOsoft, which is the firm on whose systems around half of the London Market’s claims are handled.

Aidan has been involved with the London Market for around 25 years and since the advent of the electronic claims file in 2008 DOCOsoft has built a leading market position around claims software.

Aidan and Ian are both people who anyone who has been part of the London Market community is likely to know or have met at least once.

And because of that in many ways this podcast is a personal embodiment of the ecosystem that Ian and AdvantageGo are trying to build – and this itself is a reflection of the wider ecosystem of collaborating and competing entities that make up the broader London Market that it serves.

Ian and Aidan have been collaborating for many years and get on extremely well.

So in this fun episode we get an overview of DOCOsoft and all the latest news on the ecosystem, but we also get the benefit of all of Ian and Aidan’s collective wisdom looking beyond the upcoming reforms of Blueprint 2 and into a world of straight-through processing and a market where the true benefits of new technologies such as AI are going to be reaped.

Greater productivity, better client service and outcomes and a much stronger flow of business into London are some of the prizes that Ian and Aidan can see just over the horizon.

It's inspiring stuff and the next half an hour is going to rattle by.

Tuesday Dec 03, 2024

Ep233 Dawn Miller, Lloyd's: Debunking the old Lloyd's myths

Tuesday Dec 03, 2024

Tuesday Dec 03, 2024

This podcast features an interview with Dawn Miller, Lloyd's Chief Commercial Officer and CEO of Lloyd's Americas. Miller discusses her career, her dual roles at Lloyd's, and her strategies for modernising the market's image and operations. She highlights initiatives to improve transparency, streamline processes, and attract new business.

---------

The oldest showbiz adage of them all is to always leave them wanting more and this week’s episode does exactly that

That’s because it is a very short, sharp blast of energy from start to finish.

Dawn Miller is Lloyd’s Chief Commercial Officer and has just taken over as its Americas CEO. Not many people have the energy to take on two huge roles, but it’s clear after this meeting that Dawn isn’t like many people.

Half an hour with Dawn is worth at least an hour with someone else.

So hang on as Dawn defines the essence of what her Lloyd’s roles are and she tells us her goals and strategies for presenting the best side of the marketplace to the world today.

I think Dawn is the culture change at Lloyd’s of the last few years personified.

Listening to someone as pro-active, positive and passionate as her, you already know the market has become the polar opposite of the venerable but slight stuffy institution it might once have been.

Indeed Dawn explains that probably her biggest job is debunking all the accumulated myths and baggage that have arisen around the perceived complexity, time and expense of dealing with Lloyd’s over its long history.

This one packs a huge amount into a relatively small space. You won’t have time to catch your breath.

LINKS:

We thank our naming sponsor AdvantageGo:

https://www.advantagego.com

We also thank audio advertiser, The Insurance Network (TIN), organiser of the highly-successful TINtech events series. This week they are advertising their successful TINtech London Market event, which will be happening on 4th February 2025.

Tuesday Nov 26, 2024

Tuesday Nov 26, 2024

Today’s episode is a real treat. With all Voice of Insurance podcasts the aim is to be able to get to a level of comfort and ease with a guest so that what we end up hearing is as close you can get to listening in on a lively conversation between two good insurance market friends in a bar.

This week I think we managed it and that’s down to my guest, Nick Line, the Chief Underwriting Officer of Markel International.